#SecureTheBag PROGRAMME

In 2022, the Saver Waya Waya L+EARN #SecureTheBag programme was rolled out to 22 universities and six Technical Vocational Education and Training (TVET)

colleges across all nine provinces.

Content for this programme is primarily focused on consumer financial education,

entrepreneurship, side hustles and work readiness to improve youth employability and future earnings, and to develop healthy, sustainable financial behaviors.

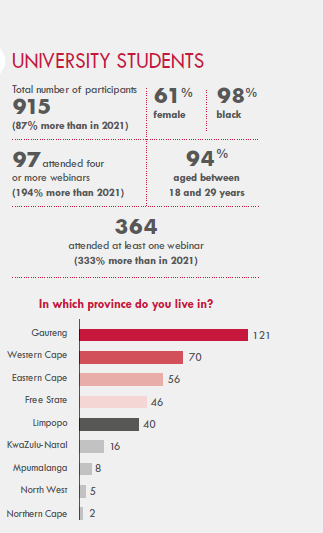

University students

DEMOGRAPHICS

To cater to this cohort, a blended learning approach was adopted, comprising an initial face-to-face workshop, followed by a series of six one-hour webinars conducted on Zoom. Additionally, engagement on the Zlto platform and supplementary support from the L+EARN website were provided to reinforce the webinar content.

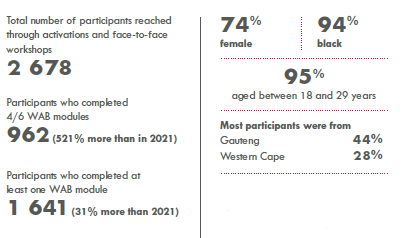

TVET College students

These students’ learning journey included an initial in-person industrial theatre session, followed by two in-person workshops. In addition, they participated in a

WAB learning journey, engaged on the Zlto platform, and had access to a closed Facebook group and the L+EARN website for further support and reinforcement of workshop content.

Impact Achieved

The impact assessment conducted with students who participated in our L+EARN #Secure the Bag programme at tertiary institutions was hugely encouraging, and

confirms the power and potential for infinite impact by educating young adults at this stage of their lives.

According to independent M&E results, the programme achieved successful knowledge transfer, although it varied across different module topics. This culminated in positive attitude shifts and an improvement in how students manage their money. This finding was consistent with previous assessments and was further confirmed by the survey results.

Even in cases where participants did not make significant changes in how they managed their finances, they were still able to demonstrate a basic understanding of the concepts discussed during the in-depth interviews.

Participants demonstrated positive attitude shifts and behavior changes, as they

reported improved money management compared to their previous practices.

Since inception, the L+EARN #SecureTheBag programme has reached 8 700 students and young entrepreneurs (54% female, 88% Black South African) in all nine South African provinces.