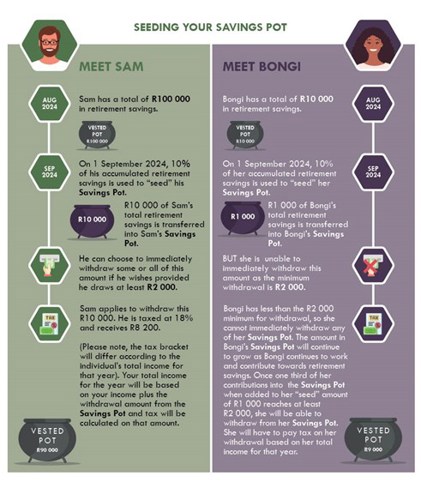

On 1 September 2024 your Savings Pot will be created or seeded using 10% of the funds from your accumulated retirement savings. You can choose to withdraw the money immediately or you can leave it in your Savings Pot in case you have an emergency in the future.

If you wish to withdraw the money you must make a minimum withdrawal of R2 000 and you may only make one withdrawal per tax year (from 1 March to 28 February) until you retire.

You will be taxed when you make a withdrawal based on your marginal tax rate (which is the rate of tax applicable as if you had received this withdrawal as salary). The fund may also charge an administration fee when making withdrawals.

Please note that you do not have to keep all the seeded funds in your Savings Pot. You may ask for all of the money or part of the money in your Savings Pot to be moved to the Retirement Pot. Note that once it has moved to your Retirement Pot, you cannot move it back to the Savings Pot.

The less you withdraw from your Savings Pot, the more money will be available together with your Retirement Pot to purchase a pension. This will improve your standard of living after retirement as all the funds in your various pots count towards your total retirement savings which will be used to purchase a pension.