In our day-to-day life we make plans every day. If you’re taking a trip you plan how to get there and what time to leave and return. But very often we don’t plan how to use our money.

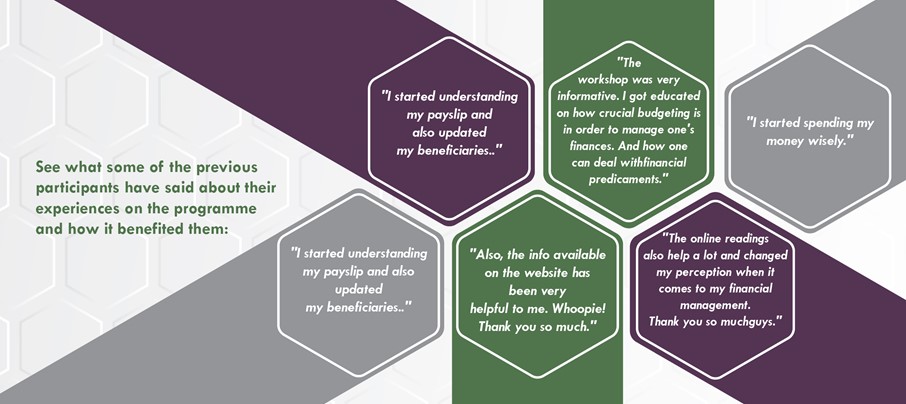

With WageWise you can learn how to manage your household finances by budgeting, how to understand your payslip and deductions. Plus, you can learn about the importance of saving, planning for your retirement and what financial products and services there are to help you plan for your future.