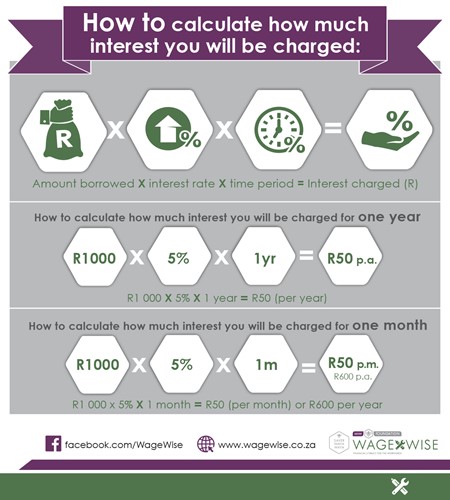

When you take credit there is an assumption that you will repay the debt in good time and that you normally have to pay the bank or shop some additional money as well. This additional money is called interest and you may be charged additional fees on top of this.

When you take credit there is an assumption that you will repay the debt in good time and that you normally have to pay the bank or shop some additional money as well. This additional money is called interest and you may be charged additional fees on top of this.

Understanding how interest works and is calculated is important to help you build your wealth.